3 Which of the Following Would Be a Progressive Tax

Your task is to determine what percentage of each taxpayers total income would go toward tax in a progressive system. Which of the following is NOT correct about a progressive tax.

Progressive Tax Economics Help

Part of solved Nature of Indian Economy questions and answers.

. Federal taxes operate under a progressive system. 1 2 3 Complete the following regarding regressive and progressive taxes. Therefore lower income earners pay a higher tax RATE than higher income earners.

Has a progressive income tax system that taxes higher-income individuals more heavily than lower-income individuals. In the United States the income tax system is progressive with seven tax brackets that increase alongside income with rates of 10 12 22 24 32 35 and 37. 2In general lower marginal tax rates provide incentives to.

Regressive taxes require you to pay a higher percentage of your individual income in taxes as your income decreases. Though the top 1 percent of taxpayers earn 197 percent of total adjusted gross income they pay 373 percent of all income taxes. For example income taxes increase according to the purchasing power of the individual high-income individuals pay higher rates than those with low-income to facilitate the burden of taxes on families with little purchasing power.

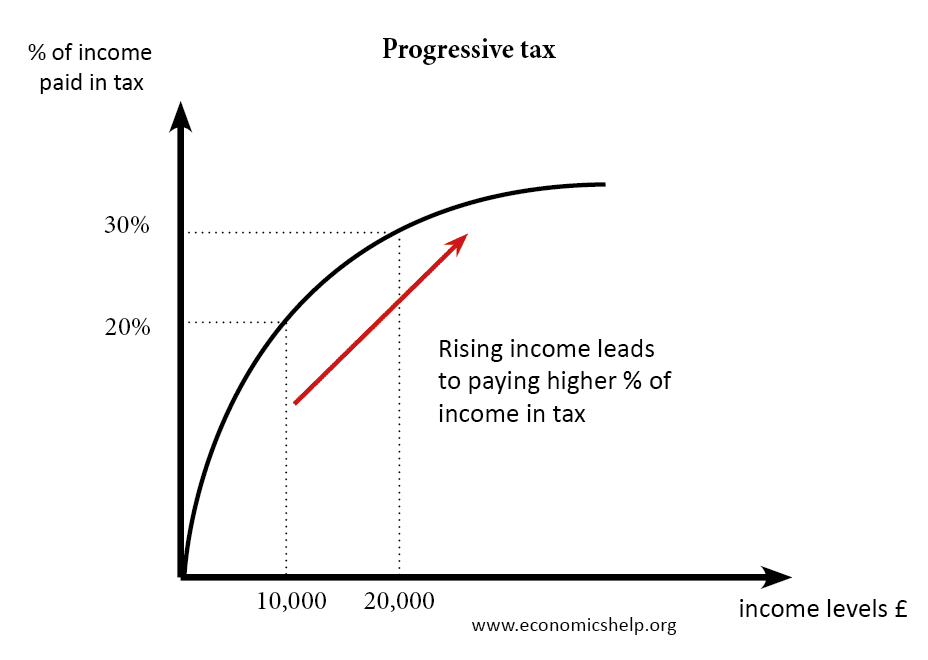

Find more tax loopholes. A progressive tax system might for example tax low-income taxpayers at 10 percent middle-income taxpayers at 15 percent and high-income taxpayers at 30 percent. If one tax code has a low rate of 10 and a high rate of 30 and another tax code has tax rates ranging from 10 to 80 the latter is more progressive.

Income up to 37950 is taxed at 15 or less in the United States in 2017. 0 percent on the first 10000 10 percent on the next 10000 15 percent on the next 10000 25 percent on the next 10000 and 50 percent on all additional income. Our tax rates are progressive.

The main concept for this system is that the more money you make the more you pay in taxes as based on a rate change related to income increases. Brigham 20150101 Progressive tax systems reduce the tax burdens on people who can least afford to pay them. 18 May 2018.

3-10 Explain the following statement. A sales tax B excise tax C property tax D federal income tax Answer. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns.

The Canadian tax system we use is a progressive tax system. Flat tax income tax property tax sales tax Both A AND B. Advantages of a Progressive Tax.

First explain what that means. A certain state uses the following progressive tax rate for calculating individual income tax. Progressive taxes are the opposite with the percentage of income you pay in taxes increasing as your income rises.

D Federal income tax rates increase as. The current federal income tax structure is progressive in nature. In the US.

A progressive tax takes a larger percentage of income from high-income groups than from low-income groups and is based on the concept of ability to pay. Second regarding the proposal for a flat tax comment on both justification for and major obstacles to enactment. Progressive taxes are those that increase according to the value being taxed.

The tax is progressive if a higher rate of tax a. Tax Round your answer to the nearest whole dollar amount. Just 3 percent of taxes are paid by the lowest half of income earners.

Which of the following taxes is a progressive tax. A tax system where the tax rate is higher on higher incomes. A progressive tax takes a higher percentage of tax from people with higher incomes.

In this case the person earning 10000 is paying 20 of their income in tax total tax of 2000 The person earning 20000 is paying 30 of their. Imposes a progressive income tax where rates increase with income. It means that the more a person earns the higher his average rate of tax will be.

6 December 2017 by Tejvan Pettinger. One key factor in the Canadian progressive tax system is that the amount of income to a certain limit is taxed at. Regressive proportional or progressive.

The next tax bracket goes to. In 2021 federal progressive tax rates are 10 12 22 24 32 35 and 37. How Do Progressive Taxes Impact.

The personal income tax in the United States which ranges from 0 on the lowest incomes to 396 on the highest incomes is progressive. The first tax rate of 10 applies to incomes of less. Progressive Tax System.

Income Progressive Range Tax Rate 0 3000 3001 5000 2 3 5001 17000 5 17001 and up 575 Calculate the state income tax owed on an 80000 per year salary. In the US federal income tax is a progressive tax. Bert faces a progressive tax structure that has the following marginal tax rates.

There is less of an incentive to earn more money in a progressive tax system if a households earned income is near a bracket cutoff. There are several different tax brackets or groupings of taxable income which are taxed at. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

Which of the following is an example of a progressive tax. 3If the tax elasticity of supply is 06 and tax rates increase by 10 percent the. As income rises the progressive tax rate falls.

Taxes fall into one of three categories based on the ratio of tax to income that you have to pay. Some may say that this is not progressive enough but as the rich pay a higher rate on income than low-income households it is still a progressive tax. People who make less than 9950 pay 10 in taxes while people who make more pay a higher rate of tax up to 37.

Which of the following is NOT correct about how tariffs. 9 Which of the following taxes is progressive. General Knowledge Economy Nature of Indian Economy.

A tax is regressive if the rate of tax applies as the tax base decreases increases b. For any given income level.

Types Of Taxes Intelligent Economist

How South African Non Income Taxes Are Paid Income Tax Income Indirect Tax

No comments for "3 Which of the Following Would Be a Progressive Tax"

Post a Comment